PREFERENTIAL IMPORT AND EXPORT TAX SCHEDULE UNDER EVFTA AGREEMENT FOR THE PERIOD 2020 –2022

Sep. 30 2020

On September 18, 2020, the Government issued Decree No. 111 / ND-CP on Vietnam's Preferential Export Tariffs and Special Preferential Import Tariffs for the implementation of the Free Trade Agreement. Socialist Republic of Vietnam and the European Union in the period 2020 - 2022 to implement Vietnam's commitments on opening the goods market in the EVFTA Agreement.

NEW DECREE

Accordingly, the Decree stipulates the Preferential Export Tariffs, the Special Preferential Import Tariffs of Vietnam to implement the EVFTA Agreement and the conditions for enjoying preferential export tax rates and special preferential import tax rates. according to this Agreement. With regard to customs declarations of exports and imports registered from August 1, 2020 to before the effective date of this Decree, if all regulations are met to enjoy tax rates If Vietnam's preferential export or special preferential import tax is paid in this Decree and has paid tax at a higher tax rate, the overpaid tax shall be handled by the customs authority in accordance with the law on tax administration.

This Decree also applies to goods exported from Vietnam to the United Kingdom and Northern Ireland and goods imported into Vietnam from the UK and Northern Ireland during the period. from August 1, 2020, to the end of December 31, 2020.

CHANGES TO IMPORT AND EXPORT TARIFF

Under the EVFTA Agreement, Vietnam commits to abolish import duties on 48.5% of tariff lines, equivalent to 64.5% of EU exports as soon as the Agreement comes into effect. Then, after 7 years, 91.8% of tariff lines equivalent to 97.1% of export turnover from the EU was abolished by Vietnam. After 10 years, this elimination is 98.3% of tariff lines and 99.8% of EU export turnover respectively. About 1.7% of the remaining EU tariff lines apply the tariff elimination schedule of more than 10 years or apply TRQ according to WTO commitments.

With regard to export taxes, Vietnam and the EU undertake not to impose export tax on goods when they are exported from the territory of one party to the other. However, Vietnam has reserved the right to impose export taxes on 526 tariff lines, including important products such as crude oil, coal (except coal for coking and coking coal). For tariff lines with relatively high current export tax rates, Vietnam has committed to a ceiling export tax of 20% for a maximum period of 5 years (only manganese ore has a ceiling of 10%). For other products, Vietnam commits to eliminate export tax according to a maximum schedule of 16 years.

*Source: evfta.moit.gov.vn

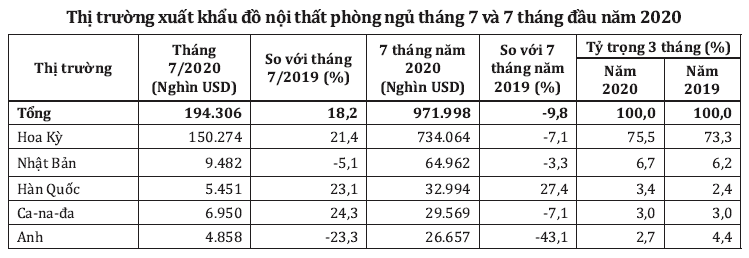

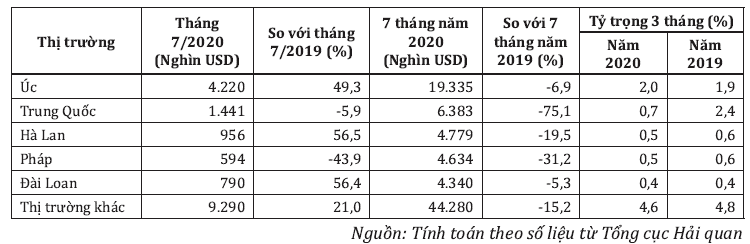

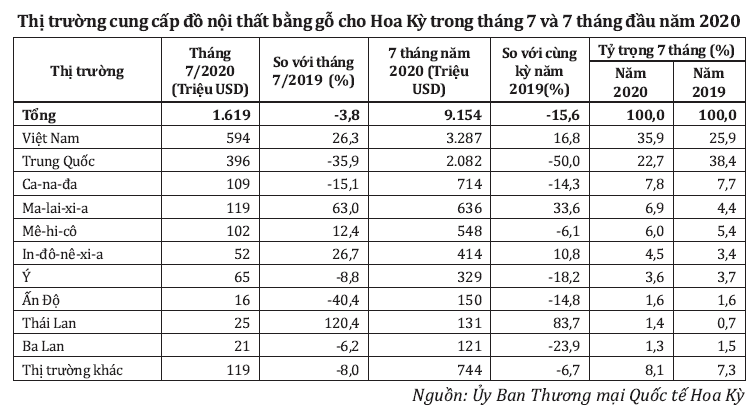

* Appendix: Bedroom furniture market situation up to July 2020*